100 Years of Successful Farm Transitions and Progress

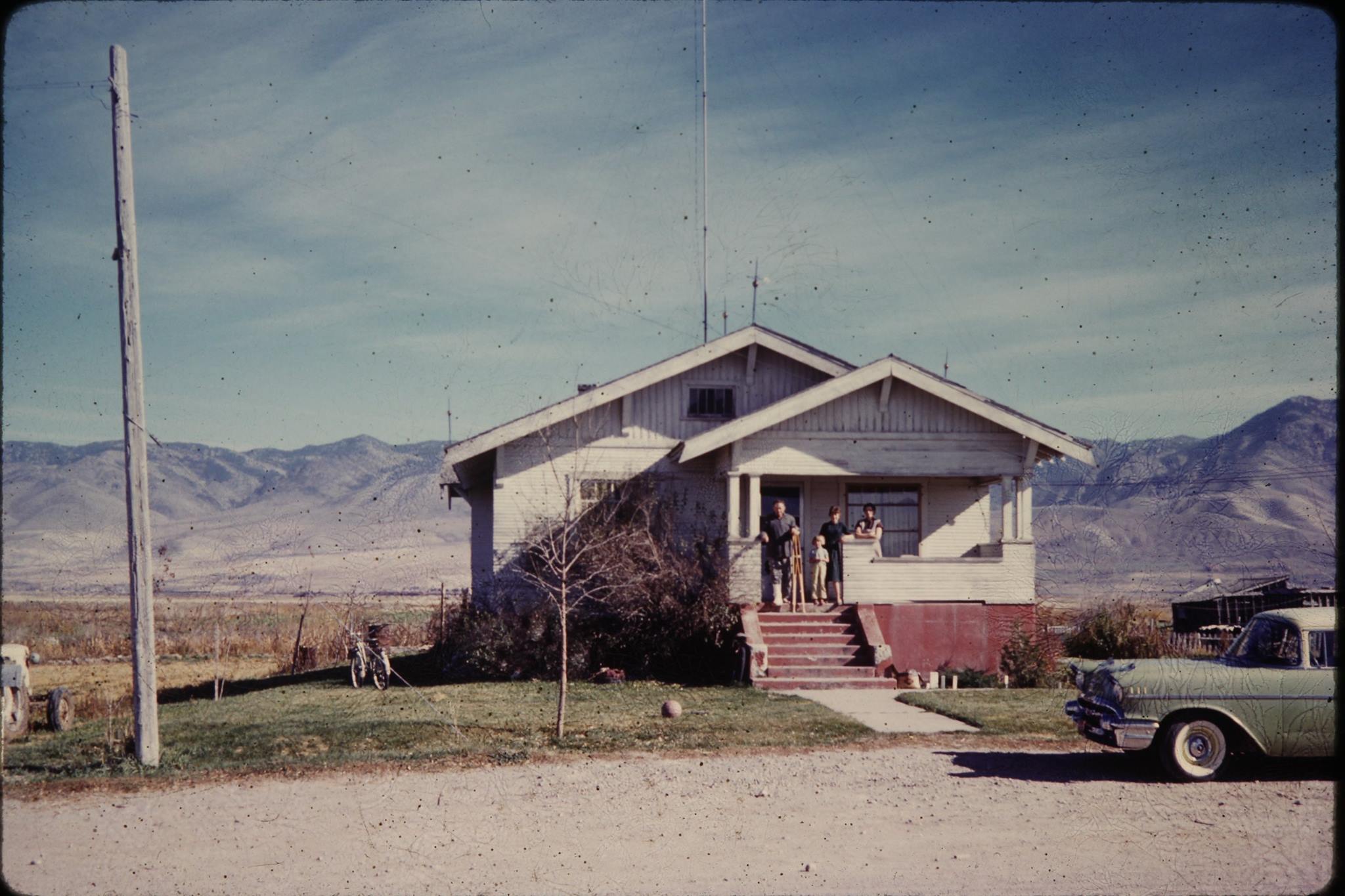

I was out with Sara and our children last week at a reunion of her dad’s family. This reunion was special because it marked the 100th anniversary of the building of the home Sara’s mom and dad live in on the farm in 1919. We were regaled with stories of the farm and its ups and downs. It was started by her great grandfather and grandmother back in the late 1800s. Her great grandfather died while her great grandmother was pregnant with her grandmother. Her great grandmother continued to run the farm for years as a widow. One of her son’s took it over, but that didn’t work out, so her daughter and her husband, Sara’s grandparents, ultimately succeeded in ownership. When they determined to step away, the farm was purchased by Sara’s parents. Now her brother is next in line. It was also easy to see the progression from the home that was built in 1919 to their new robotic dairy barn that is under construction as short distance away.

All of the stories inevitably turned my mind to the many farm families we work with in farm succession planning. So I thought I would share some general guidance I shared quite a few years ago from one of the pre-eminent scholars in the area of planning for farms and ranches, Neal Harl. The first thought is to know what you are trying to accomplish. Harl says: “The chances are quite good that if one can identify his or her objectives then the law, in its enormous flexibility, can be used to accomplish those aims.”

While a succession plan will not guarantee the continuation of the business, it will certainly increase the likelihood. I agree with Harl when he says: “the greatest value comes from the process of working through a succession plan, not the final product.”

Here are a few more tips from Neil Harl:

DEVELOP A STRONG COMMUNICATION SYSTEM. Minor problems can become major headaches because of poor communication.

BUILDING A MANAGEMENT TEAM. Focus on developing management skills of team members and giving them an opportunity to develop a broad understanding of the business, including financial, marketing, legal and personnel matters.

THE “POWER” ISSUE. Examine where decision-making power will be held and put in place provisions to assure an acceptable balance of power. Work to create an environment where the merit of an idea is valued over where it comes from.

ASSURE FAIR COMPENSATION. Less than fair compensation of potential successors with the intent of “someday making it right” is a recipe for distrust and loss of loyalty.]

ANTICIPATE DISRUPTIONS. Consider the possible disruptions and response strategies. Death, Divorce, and Disability are the three “Ds” of disruption. Buy-sell agreements and proper insurance can help greatly. Make sure there is a plan for a “smooth” transition.

VALUE OF OWNERSHIP INTERESTS. Generally, there is no ready source of information on what an operation is worth. One of the best approaches is to periodically re-negotiate a fixed price with a back-up appraisal method if an agreement is not reached.

PHASED RETIREMENT. While it is never easy, timelines should be established and incentives put in place to encourage the older generation to move toward retirement. This can also be helped by establishing a retirement plan to help fund the retirement. Relying solely on the sale of the business as the “retirement plan” can make transition more difficult.

PROTECT MINORITY OWNERS. If there will be minority owners or passive owners, those interests should be protected from abuse at the hands of the majority. This protection should include an exit strategy. I generally discourage passive owners in the farm or ranch business. These individuals rarely see the value that comes from re-investing in the business and rightfully expect to see a return on their ownership interest. This can lead to dissension and litigation.

Again, it is not just the ultimate plan that matters, but also the journey in getting there. The process itself will strengthen your business and make it more valuable. This along with the systemization of the business will allow it to become something that has value above and beyond its component parts and truly worth passing on.

This post is for informational purposes only and not for the purpose of providing legal advice. You should contact an attorney to obtain advice with respect to any particular issue or problem. Nothing herein creates an attorney-client relationship between Hallock & Hallock and the reader.